For most freelancers and entrepreneurs, accounting is an annoying subject with which they actually want to spend as little time as possible. We show you in which cases the help of an accounting software make the deal for the management of your finances. Plus, we will take a look at 6 different providers – making it easy for you to find the right tool for your business.

Since your finances are "unfortunately" a very important part of your activity as an entrepreneur, without which you will not get far in your business, you should always have an overview of them. Of course, the easiest way to do this is with a suitable accounting software. I would like to use this article today to tell you more about it and to introduce you to some popular providers in this area.

Why do I need accounting software?

Whether you are a freelancer, self-employed or shop owner - once you have provided your service or sold products, you have to write an invoice to earn money.

At what time you write invoices, of course, is up to you. Some do it directly after work, others at the end of the month.

But one thing is always the same: Accounting costs time. Time that you rarely have, especially as a self-employed person, freelancer or shop owner. But just the finances are an important part of our daily work.

Of course, some processes can be completely automated. Shop operators in particular can usually benefit from systems such as WooCommerce benefit from. Because with the help of add-ons, invoices can be created automatically. However, a certain effort for accounting still remains.

The task of a good accounting software should therefore be to be able to do as much paperwork as possible with as little effort as possible. Only in this way can we continue to focus fully on our work as self-employed people.

What accounting software modules are offered?

Anyone who has already taken a closer look at the topic of accounting software will quickly notice that not all software is the same. Because each provider has different modules or versions in its area.

Not every module is suitable for every self-employed person. For small businesses, a basic/beginner package for writing invoices is usually sufficient.

However, self-employed people who are already obliged to double-entry bookkeeping and therefore have to prepare their balance sheets, cannot do without a suitable accounting module. If you are also a shop operator, there is no way around an inventory management system.

It is also important to divide the software into those that you can only use offline and those that you can only use online.

Invoice - For beginners

The entry-level module for accounting software usually only includes the pure writing / cancellation of invoices and offers. In addition, payment reminders can be created and customer data can be managed.

Accounting - Advanced

With this accounting module it is also possible for you as a self-employed person to create e.g. delivery notes and order confirmations. In addition, online banking, item and receipt management are available here, so that these can be directly assigned to the sales within the software.

Some other important functions are the creation of an income statement, advance tax return, profit and loss statement, balance sheet and the management of assets. Of course, you can also keep a cash book here if necessary.

Merchandise management - For professionals and entrepreneurs

The merchandise management module is also used by self-employed persons and companies to manage goods, suppliers and prices. Stocks can be booked in and out, new goods can be created and individual customer prices can be set.

Basic Functions: Every accounting software should contain these functions

A useful accounting software should include some very important basic functions for daily work. In my view, these should include the following:

- Writing invoices / quotations

- unlimited number of bookings

- Document management (entry / posting)

- Product / service management

- Cashbook

- Merchandise Management

- Online banking

- EÜR

- P&L

- Balance

- Elster interfaces (advance return for sales tax, etc.)

- DATEV

- Tax consultant access

- Import / Export of data

- Smartphone app

As I mentioned above about the different modules, you always have to consider which functions you actually need.

Offline accounting software: 3 providers in comparison

As the name probably suggests, offline accounting software is a program that can only be installed on a PC or MAC.

Only then can it be used by you afterwards. However, it is remarkable that the classic "offline" accounting software hardly exists today. Almost all well-known providers such as Lexware or Sage now also offer a cloud function in their desktop versions.

Thus, even with these offline programs, relevant data can be accessed via the internet (e.g. as an app) while on the go. In the following, I would like to introduce you to three very well-known providers of offline accounting software:

- Lexware

- WISO Accounting 365

- Sage50 Accounting

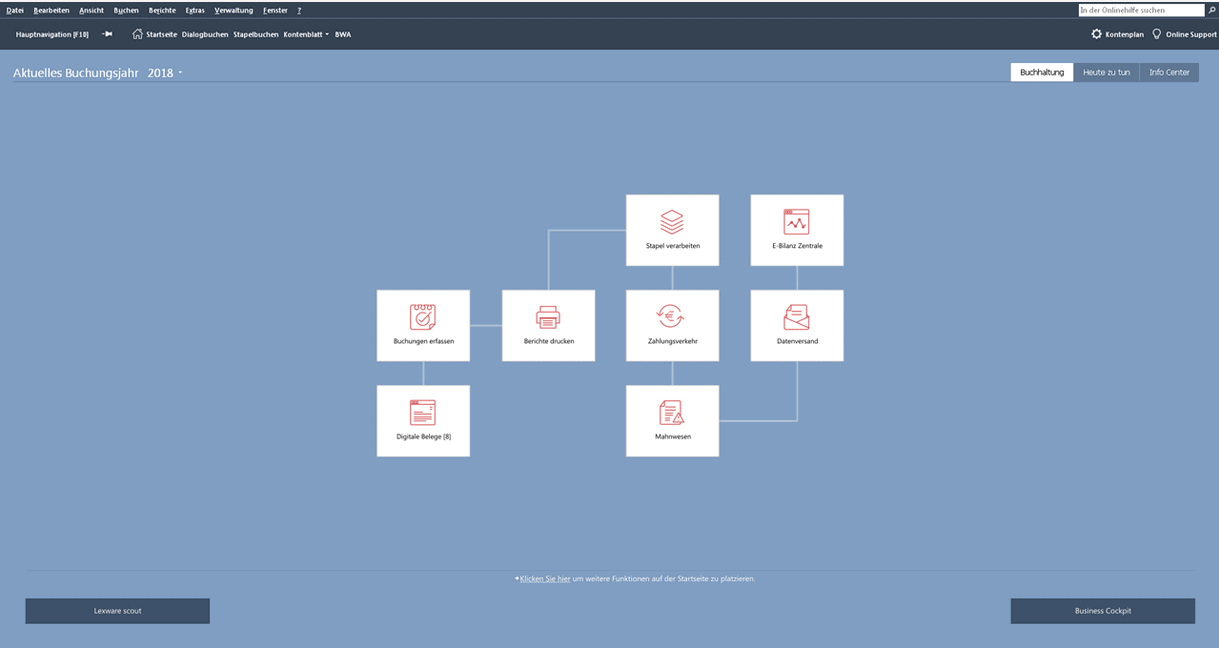

Lexware

The accounting software from Lexware is suitable for all those self-employed persons and entrepreneurs who are obliged to double-entry bookkeeping, as well as for those who only have to prepare an income statement (EÜR).

Lexware Accounting is available in up to 6 modules:

- Base

- Plus

- Plus (+ Support Service Package)

- Pro

- Premium

- Premium (+ Support Service Package)

Single-user modules:

Multi-user modules:

The modules differ mainly in the scope of the available functions. From the Plus module, for example, a cash book function is included as well as the annual VAT declaration. From the Pro module a SYBASE database and the management of several companies.

With the Premium module, the user also receives the asset management function. The Plus and Premium module can additionally be booked with a support service package.

Via "Lexware mobile", data such as document data, customer / supplier data, article data as well as important company key figures can be accessed directly online via a browser.

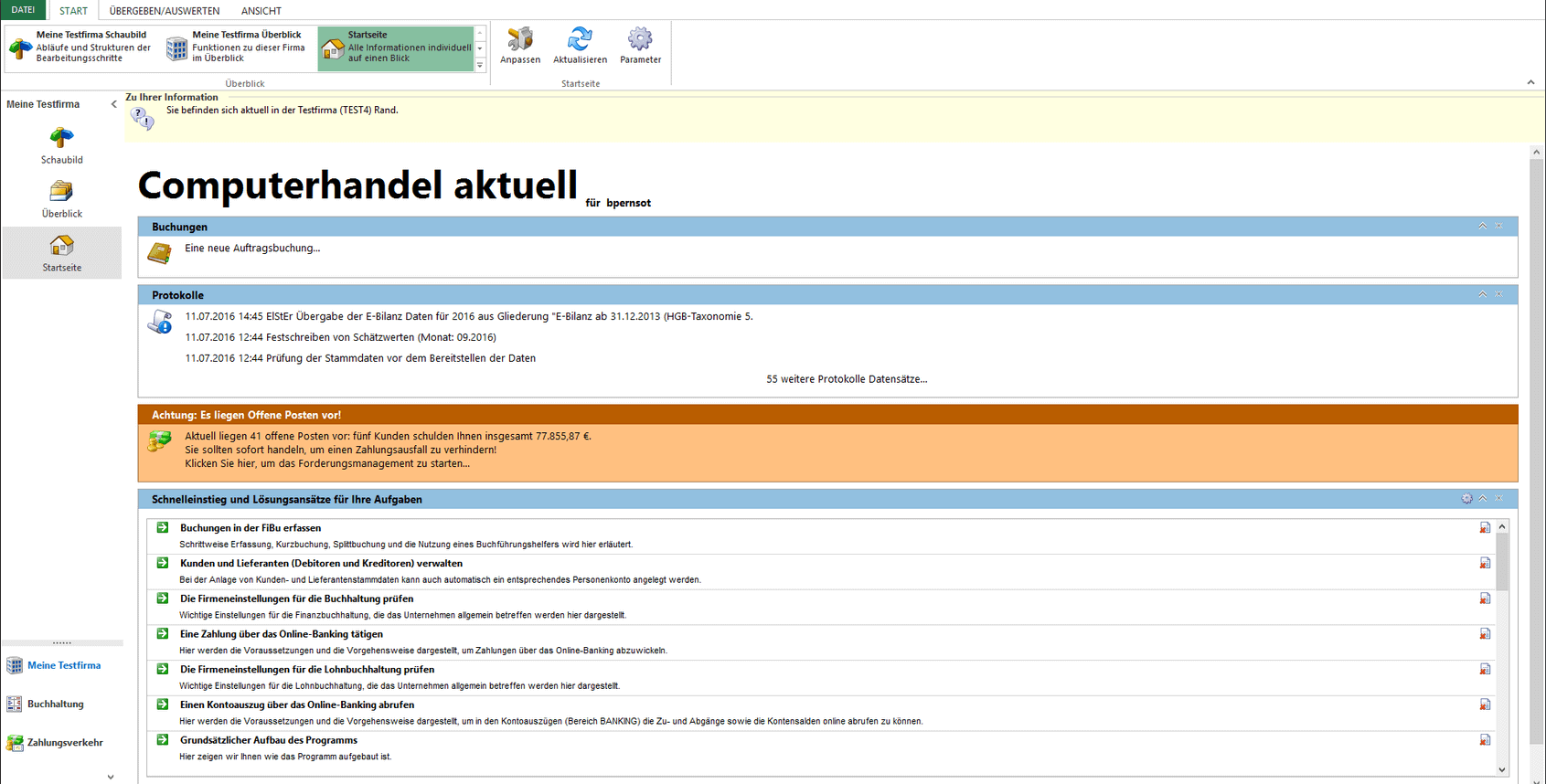

WISO Accounting 365

WISO Accounting 365 is ideal for accounting in small and medium-sized businesses. The software is suitable for the preparation of a balance sheet, income statement and profit and loss statement.

The accounting software is available in two different modules:

- WISO Accounting 365

- WISO Accounting 365 Professional

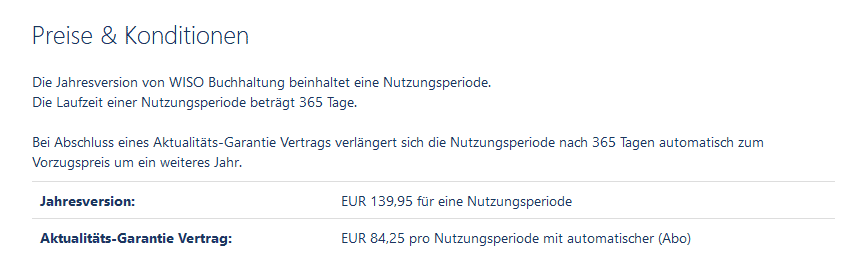

WISO Accounting 365

WISO Accounting 365 Professional

The biggest difference between these two versions is that with WISO Accounting 365 Professional can also be used in a network. Up to 5 workstations can then communicate with the accounting software simultaneously.

Further information about WISO Accounting 365 you can find at buhl.com read.

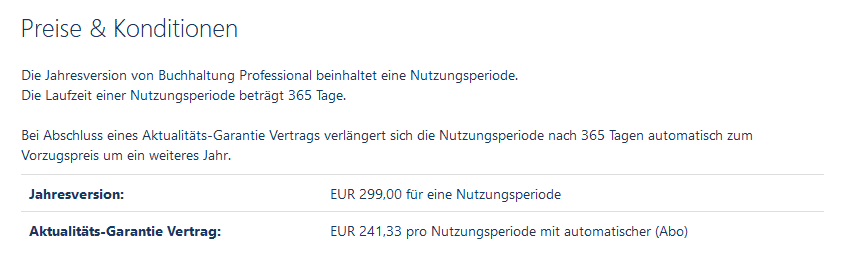

Sage 50 Accounting

The software Sage50 Accounting is suitable for all self-employed and companies that want to manage processes such as order processing, inventory management and financial accounting within one tool.

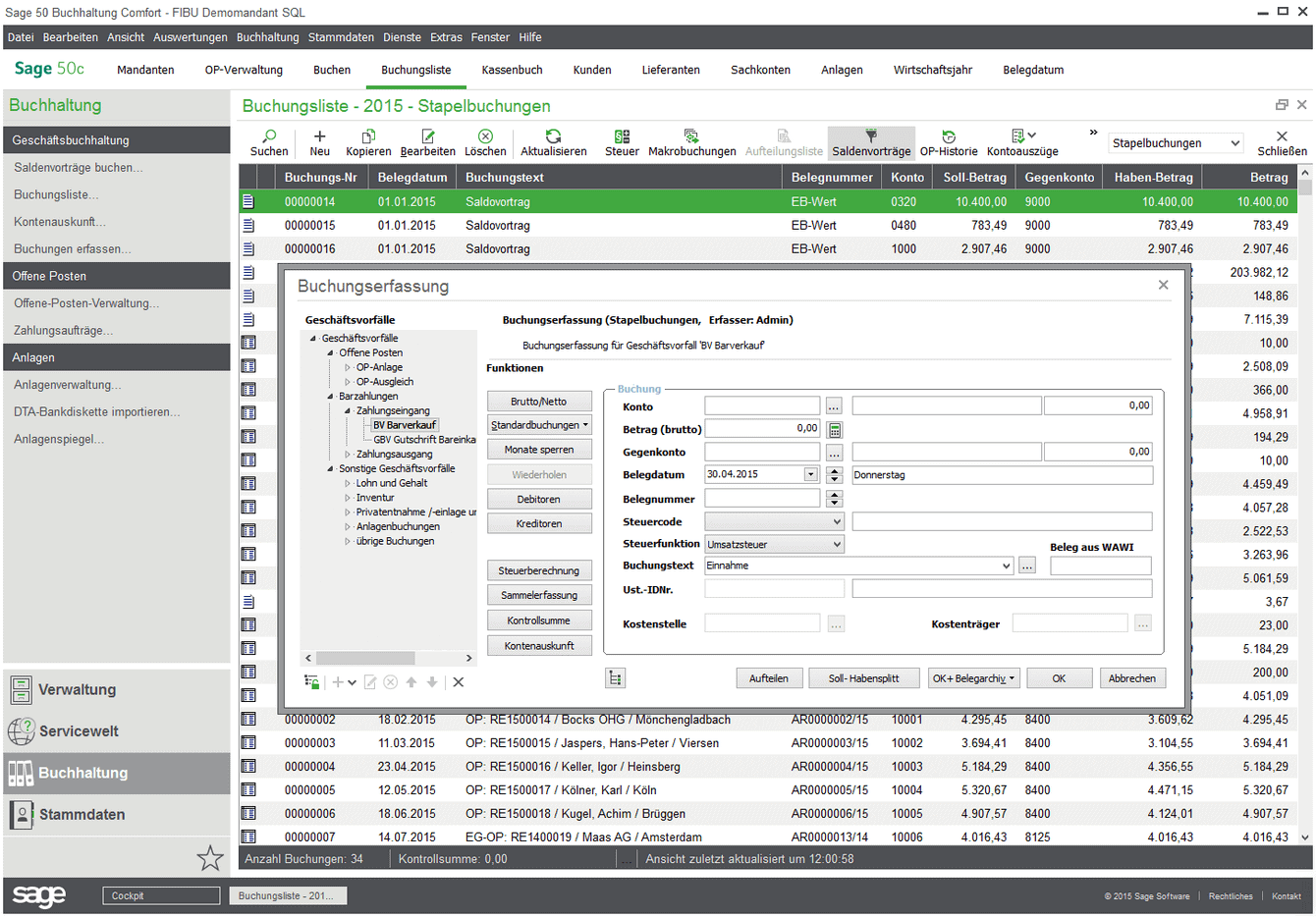

Sage50 Accounting is available in 4 different versions:

- Standard

- Comfort

- Professional

- Quantum

The four modules each differ in the type of functionality. The "Comfort" module includes budget management, ordering and e-invoices. From the "Professional" module, the function for the customizable boss overview and different variants for article management. The "Quantum" module also includes the functions for terminal operation, use at up to 20 workstations and batch management.

A cloud function is available in all modules of Sage50 Accounting integrated. This can be used, for example, to process and manage orders, contacts and appointments via Microsoft Office 365. In addition, the Sage Capture App archive receipts.

More information about Sage50 Accounting you can visit sage.com read.

The most important functions in direct comparison:

| Functions | Lexware Accounting | WISO Accounting 365 | Sage 50 Accounting |

| Invoices / Offers | ✔ | ✔ | ✔ |

| Document management | ✔ | ✔ | ✔ |

| Product / service management | ✔ | ✔ | ✔ |

| Cashbook | ✔ | ✔ | ✔ |

| Merchandise Management | ✔ | - – | ✔ |

| Online banking | ✔ | ✔ | ✔ |

| EÜR | ✔ | ✔ | ✔ |

| P&L | ✔ | ✔ | ✔ |

| Balance | ✔ | ✔ | ✔ |

| Magpie | ✔ | ✔ | ✔ |

| DATEV | ✔ | ✔ | ✔ |

| Tax consultant access | - – | - – | - – |

| Import / Export | ✔ | ✔ | ✔ |

| Smartphone app | - – | - – | ✔ |

| Users | 1-5 | 1-5 | 1-20 |

| Price* | €178,80 – €693,60 | €139,95 – €299,00 | €329,00 – €2,087 |

*All prices are annual prices (September 2019)

Online accounting software: 3 providers in comparison

With online accounting software, unlike offline accounting software, the data is not stored locally on a computer or MAC. Rather, the data is stored in the so-called cloud.

This has the great advantage that the accounting software can always be accessed from anywhere. As a self-employed person and entrepreneur, you are therefore very flexible, because you always have the possibility to get an insight into your accounting.

Another big advantage of online accounting software, in my opinion, is that many providers offer a free trial period. This way you can test all functions as a self-employed person, freelancer and entrepreneur before you decide on a software.

In addition, the tools always have an app with which you can access all important data via your smartphone. In the following section, I would like to introduce you to three popular providers of online accounting software:

- lexoffice

- sevDesk

- Sage Business Cloud

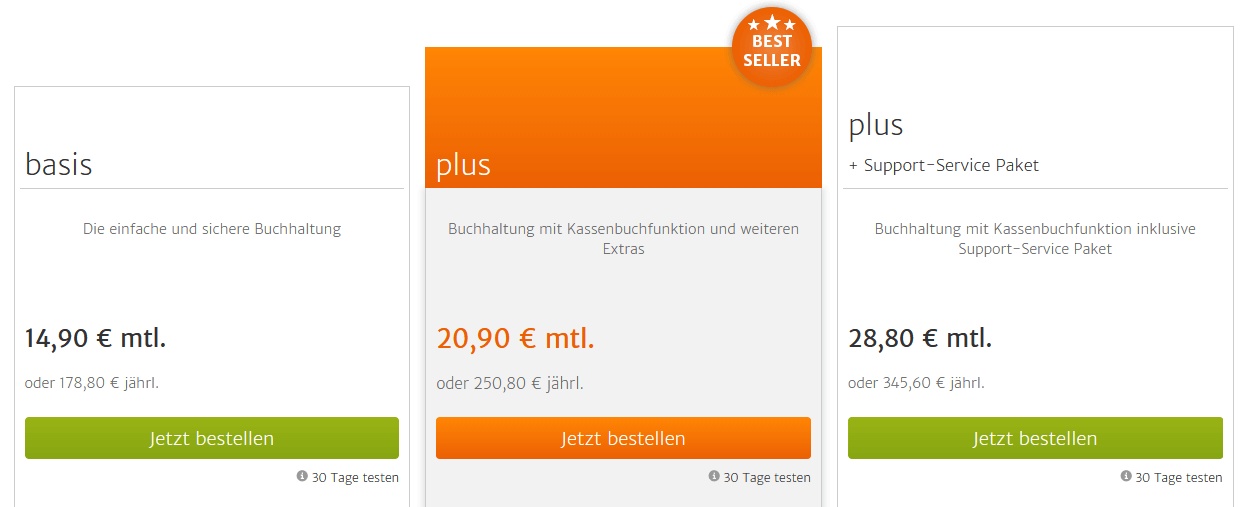

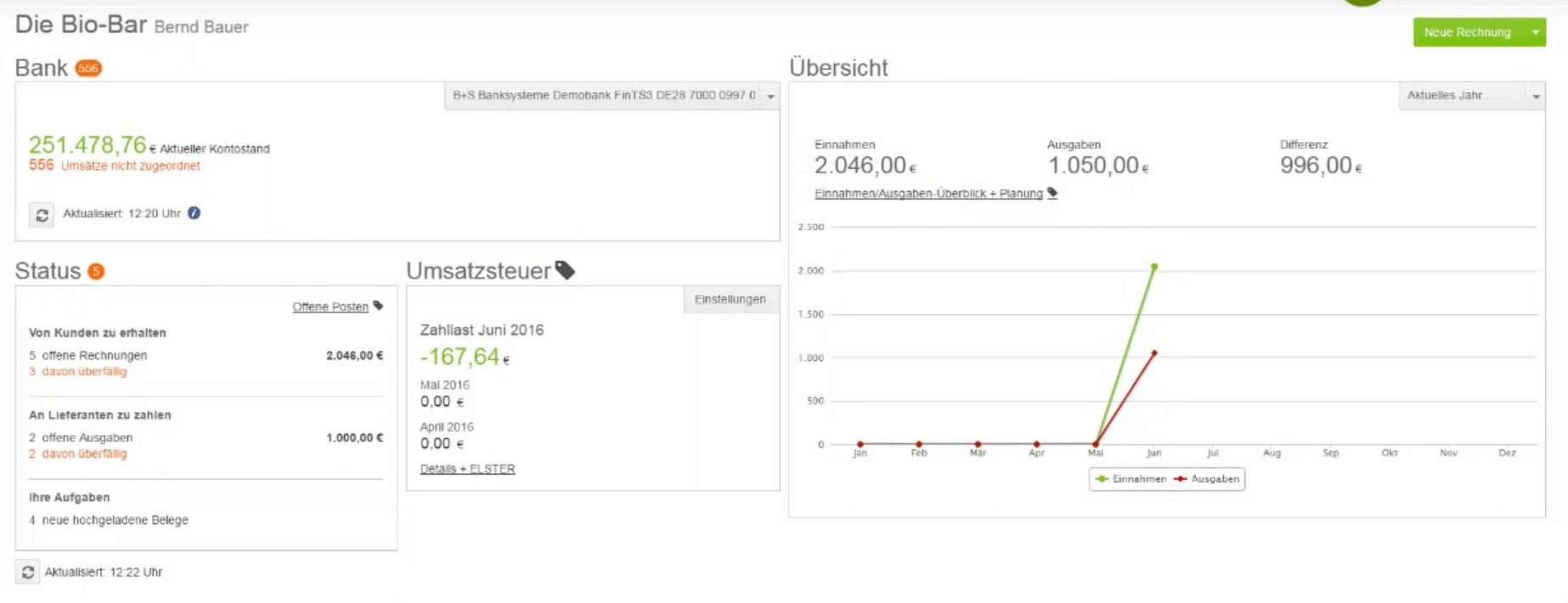

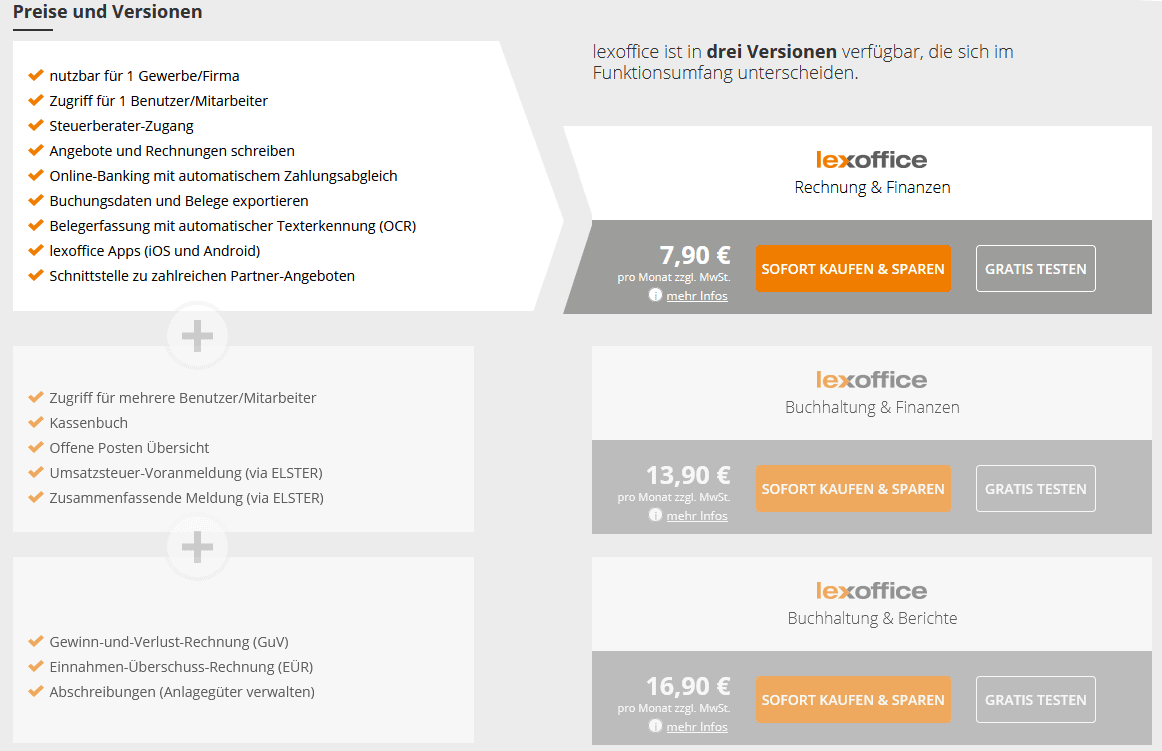

lexoffice

With the online accounting software from lexoffice can be used to write invoices, create offers, manage customers and prepare tax returns. It is suitable for entrepreneurs, the self-employed, small business owners or founders.

Lexoffice is available in 3 different modules:

- Invoice & Finances

- Accounting & Finances

- Accounting & Reports

The individual modules differ in the scope of functions. Thus, from the "Accounting & Finance" module onwards, functions such as the cash book, an OP overview and the advance VAT return are included. The "Accounting & Reports" module also includes the option of creating a profit and loss statement (P&L) and a cash flow statement (P&L). Furthermore, fixed assets can be managed and depreciated here.

Lexoffice has an app that can be used to create offers or invoices, manage contacts or check account balances. With the help of the receipt app, receipts can also be photographed and uploaded directly via smartphone.

Further information about lexoffice you can find on lexoffice.de read.

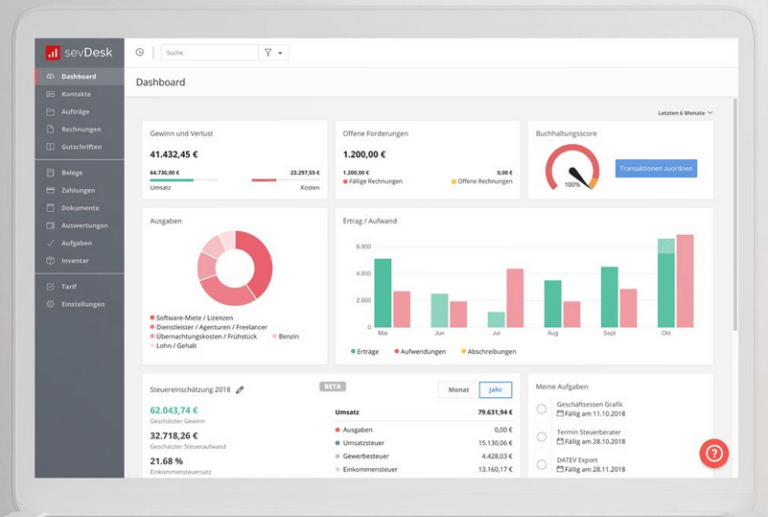

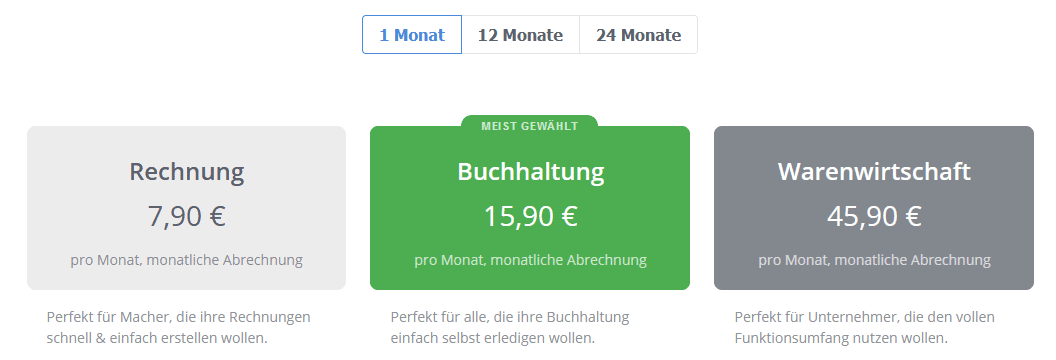

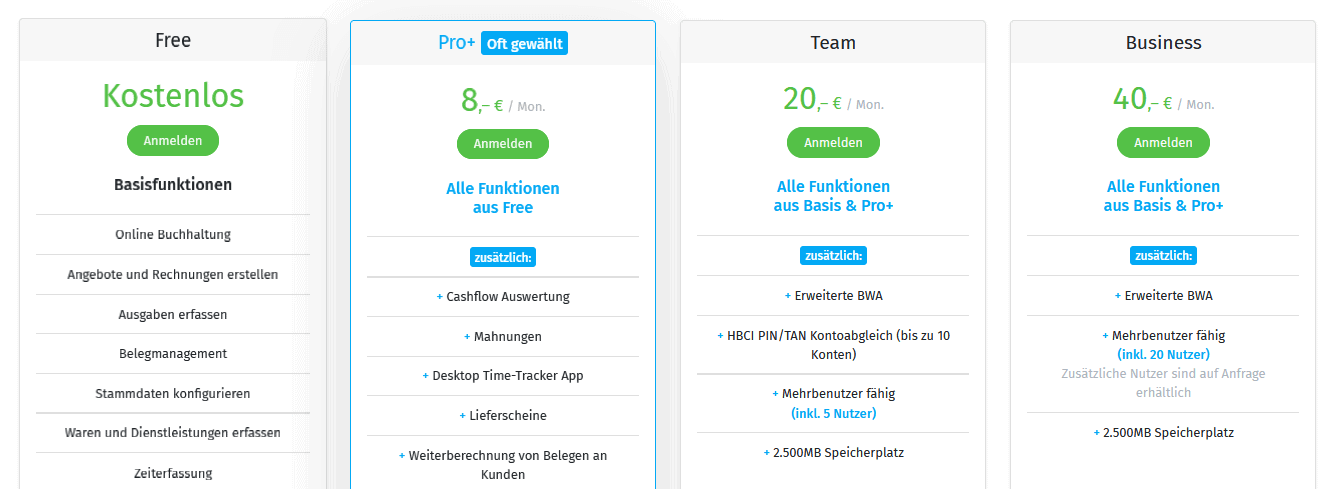

sevDesk

Also with sevDesk is a pure online accounting software that can be used to write invoices, manage customers and post incoming payments. The accounting tool is particularly suitable for the self-employed, small business owners and founders.

For users of sevDesk there are 3 different modules to choose from:

- Invoice

- Accounting

- Merchandise Management

Likewise, the individual modules differ here in the range of functions. The accounting module includes additional functions such as recurring invoices, digital document management, advance VAT return, a cash book, online banking and much more.

The merchandise management module provides you with additional functions such as warehouse management, stock postings, price variants for suppliers and supplier and article allocation.

By means of the available sevScan App invoices, offers, reminders or contacts can be created via smartphone. In addition, receipts can be viewed at any time while on the move.

Further information about sevDesk you can find on sevdesk.com read

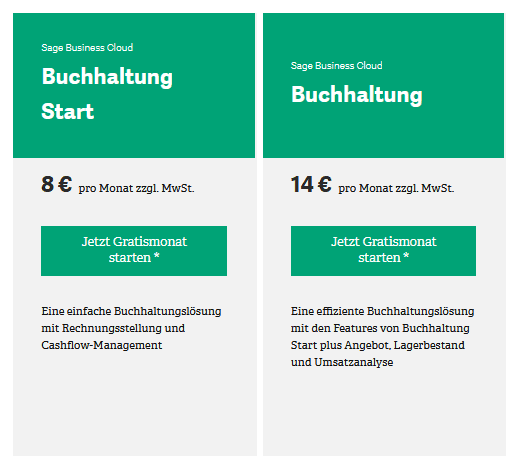

Sage Business Cloud

Sage Business Cloud Accounting is an online accounting software for founders and self-employed people. You can use it to create invoices and quotes, use online banking and create evaluations and reports.

The tool from Sage is currently only available in 2 modules:

- Accounting Start

- Accounting

Both modules offer you as a user different functions. The "Accounting Start" module is mainly suitable for invoicing and payment allocation.

The scope of functions of the "Accounting" module includes inventory management, multi-user, writing quotations, creating delivery notes and a DATEV export.

The accounting tool Sage Business Cloud Accounting also offers its users an app for on the go. With this, invoices can be created and current cash flow figures or reports can be viewed.

Learn more about Sage Business Cloud Accounting you can visit sage.com read.

The most important functions in direct comparison:

| Functions | lexoffice | sevDesk | Sage Business Cloud |

| Invoices / Offers | ✔ | ✔ | ✔ |

| Document management | ✔ | ✔ | ✔ |

| Product / service management | ✔ | ✔ | ✔ |

| Cashbook | ✔ | ✔ | - – |

| Merchandise Management | ✔ | ✔ | ✔ |

| Online banking | ✔ | ✔ | ✔ |

| EÜR | ✔ | ✔ | ✔ |

| P&L | ✔ | ✔ | ✔ |

| Balance | ✔ | ✔ | ✔ |

| Magpie | ✔ | ✔ | ✔ |

| DATEV | ✔ | ✔ | ✔ |

| Tax consultant access | ✔ | ✔ | ✔ |

| Import / Export | ✔ | ✔ | ✔ |

| Smartphone app | ✔ | ✔ | ✔ |

| Users | 1 - unlimited | 1 - unlimited | 1 - unknown |

| Price* | €7.90 – €16.90 | €7.90 – €45.90 | €8.00 – €14.00 |

*all prices are monthly prices (September 2019)

Offline vs. online accounting software

The type of accounting software you choose as a self-employed person, founder or entrepreneur depends on your personal needs. If we start from the pure range of functions, the offline accounting software is in no way inferior to the online accounting software.

However, it has one major shortcoming: it can only be used via a desktop. A tool like Sage50 Accounting also offers a cloud function here, but unlike the purely online programs on the market, this is very limited in its range of functions.

If you want the flexibility to write invoices and quotes or view current sales and reports while on the go, online accounting software is better for you.

Furthermore, in an online accounting software, accesses for the tax advisor can be set up directly. This is not so easily possible in offline tools. Here, usually only the DATEV export and the transmission of the data to the tax office remains.

Free accounting software - The entry with basic functions

As a founder and small business owner, you naturally want to generate as few expenses as possible in the beginning. This is of course understandable. Because it usually takes a few weeks and months until the company or self-employment starts.

However, if you still don't want to miss out on a feature-rich accounting software, you should go for a free online accounting software for starters that will provide you with all the basic features.

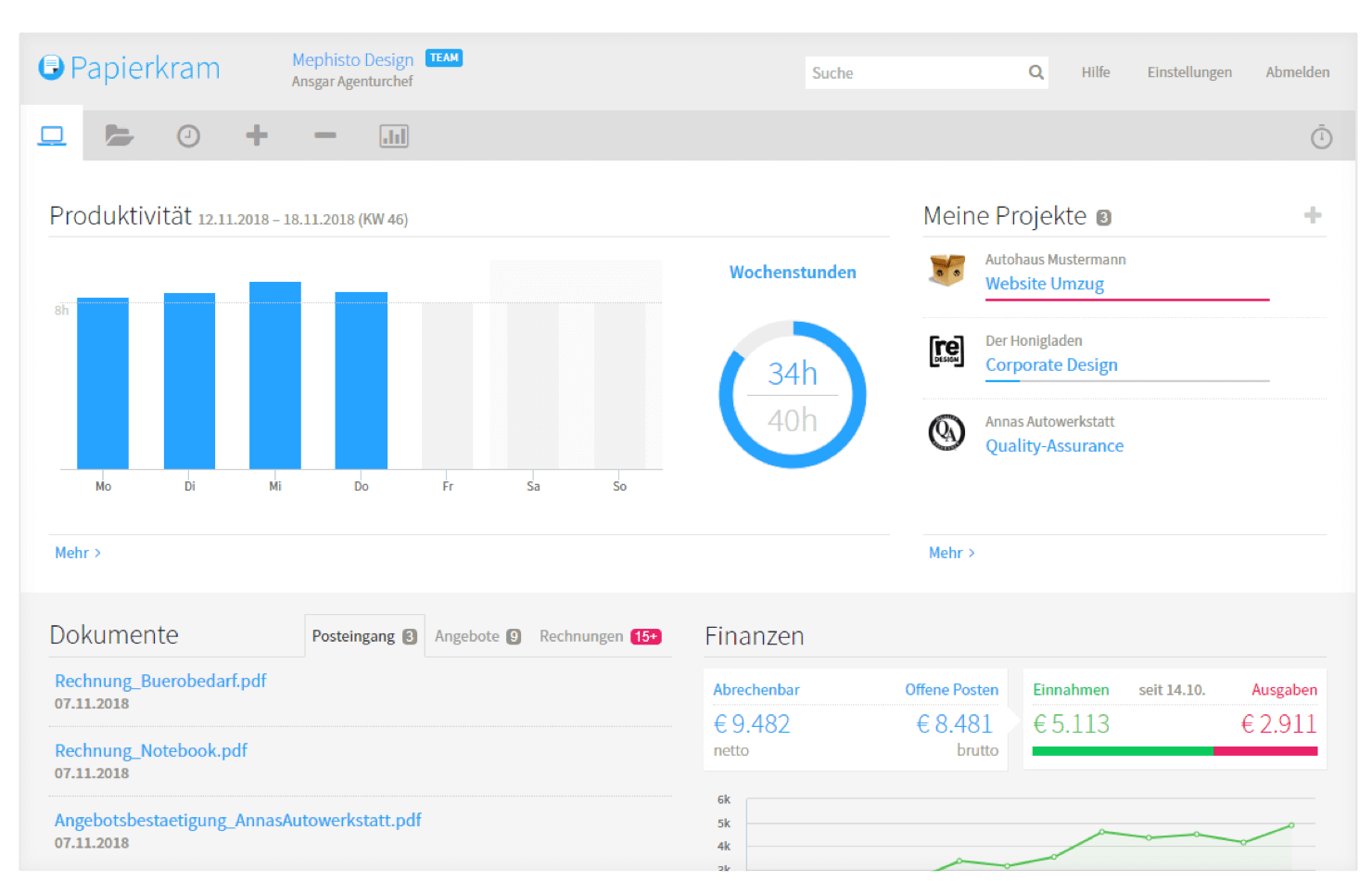

From my own experience I can recommend with a clear conscience the provider paperwork provider.

This offers you a free version with all basic functions. This includes the writing of offers and invoices, the recording of expenses, goods and services, document management, the management of master data and time recording.

More about the provider Paperwork you can find on papierkram.de read.

My personal experience with accounting software

Accounting is stupid and time consuming! That's what most people who are reading this article are thinking. But with the right accounting software you can really save a lot of work.

When I was a part-time self-employed bookkeeper, accounting software like Paperwork was completely sufficient. I also only used the free version at the beginning and was very satisfied with it. For this reason, I can only recommend it to you.

However, when it became clear that I was going to go full time into business for myself, I again compared some interesting tools - even though paperwork of course offers further modules in this area.

I can already tell you one thing: There are really incredibly good programs and providers in this area! It was especially important to me that I can assign my sales and receipts directly via the tool (online banking).

Furthermore, I wanted to have insight into my current figures at any time via my smartphone and scan receipts without detours via the app. In addition, I love statistics or reports in which I can look at current developments. In other words, I want to be able to create an EÜR or P&L at any time.

After a really extensive research I finally decided for Lexoffice and I do not regret it until today. What I particularly like: New features are added almost monthly. So the developers are very diligent here. The support also responds within a very short time.

Of course, this is just my personal experience ;-). As I said, there are also many other great providers out there that offer just as great features as lexoffice offer. If you are interested in the tool, then feel free to read my review on my blog. Here I have lexoffice in detail.

Conclusion

Founders, self-employed and entrepreneurs should use accounting software right from the start. With this, you simply ensure clear finances from the beginning and have your accounting at any time in view.

Whether you use an offline or online accounting software for this is of course only of secondary importance and is up to you. Here it depends entirely on your personal taste.

If you only want to store your data locally, then use an offline tool. However, if you have the desire to have insight into your accounting at any time while on the road, then you should opt for an online tool.

I hope I was able to clear the accounting software jungle a bit for you. If you still have questions or input on the topic or you are missing an accounting tool in the list, feel free to leave me a comment.